Investment Advisory Services offered through LFS RIA, LLC, a Registered Investment Advisor.

The Income for Life Model may be implemented using various types of financial products. Securities are placed under a fee arrangement through LFS RIA, LLC. Financial products that are not classified as Securities may be offered using a commission or a fee arrangement.

According to Kiplinger, "The biggest threat to retirement wealth is withdrawing too much money from a shrinking nest egg, because there may not be enough left to benefit from the inevitable market rebound."

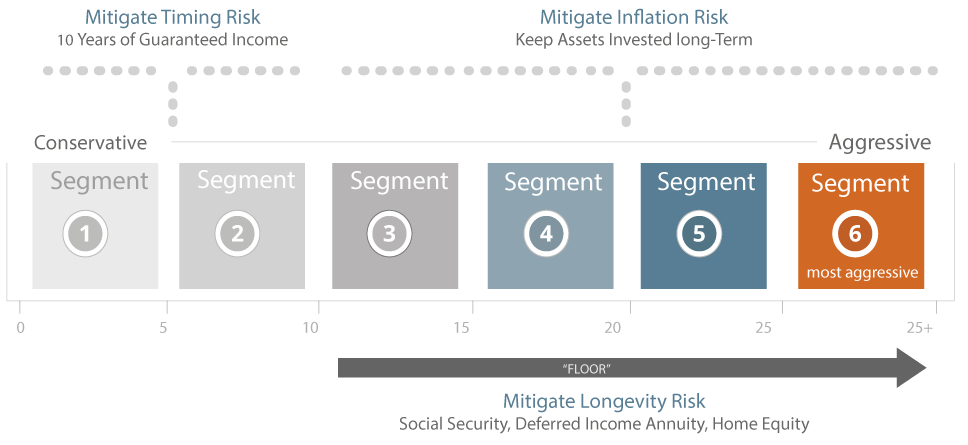

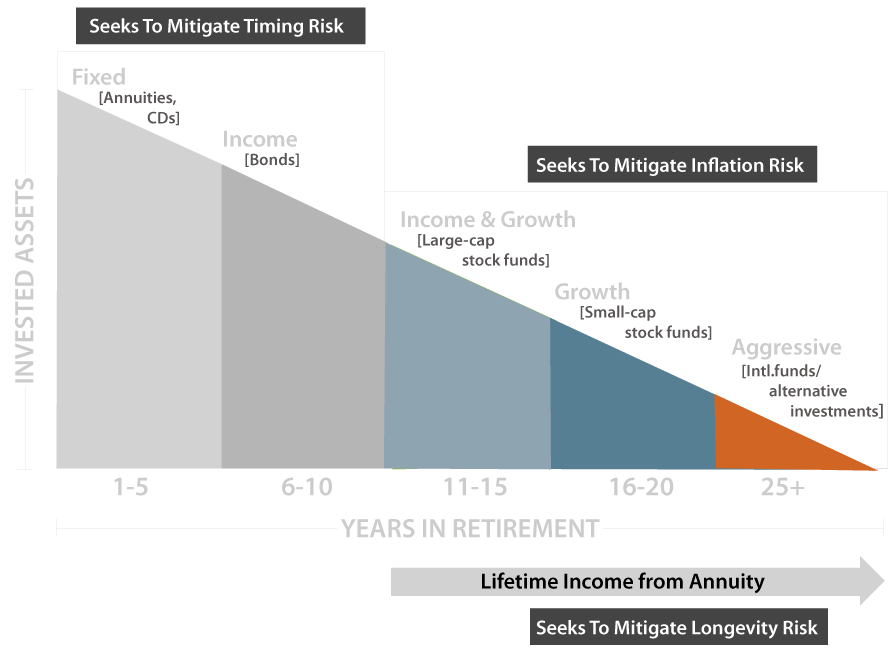

That statement is correct, and it argues for "time-segmenting" your retirement savings. Time-segmentation makes it easier to align your retirement timeline with your investment strategy. It may also help you mitigate Timing Risk and Inflation Risk. By supplementing Social Security with a deferred income annuity, you can also better protect against Longevity Risk- the possibility of outliving your income.

In one popular approach your deposit is shown as being allocated to six "segments" that will hold investment assets ranging from very conservative to aggressive. Segment One, the most conservative, receives the largest portion of your deposit - 28%. Successive segments receive, 26%, 20%, 13% 7% and 6% (total 100%). The segments receiving the smallest amount of money are those which hold progressively more aggressive assets. The more aggressive an investment, the more risk it is subject to. These segments will be held for the longest period of time in an attempt to achieve the best possible chance of excellent investing results.

Investment strategies may be subject to various types of risk including, but not limited to, market risk, credit risk, interest rate risk and inflation risk.

Constrained Investors are well-served with an income plan that blends both conservative and riskier investments.

The Personalized Analysis describes your custom plan for creating monthly retirement income.

It shows how your savings can be divided into multiple segments, each one earmarked to produce monthly income during various phases of your retirement: years 1-5, 6-10, 11-15, 16-20 and 21-25. The goal is to increase your income as you age.

Your income plan will include a "Floor", made up of those income sources which are stable and predictable- Social Security, pensions and income from annuities- and an "Upside," which is that portion of your savings exposed to investment risk. In this way, some of your money is exposed to market based growth potential, but your base monthly income is always predictable because it is produced by income sources that are not exposed to market risk. This is the key to a disciplined plan that seeks to keep pace with inflation, and that you can keep consistent with throughout retirement, and through all economic conditions.

Investments in model strategies may expose the investor to risks inherent with the model and the specific risks of the underlying investment directly proportionate to their allocation. All investments involve the risk of potential investment losses, including the loss of some or all of your principal.